The rise of ethical investing in financial advice

Jan 14, 2022

According to new research from Investment Trends, ethical and responsible investing is the fastest growing priority area for financial advisers. Client demand represents the biggest driver for ESG investing (environmental, social, and governance), for both financial advisers and product providers. And the next step for advisers, according to Investment Trends, is prioritising education.

Responsible investing practices doubled in importance for financial advisers through 2021 according to researcher Investment Trends, which calls it the fastest growing priority area for advisers right now.

In 2021, advisers reported to Investment Trends that over 40% of clients have requested to buy or sell investments based on environmental issues, up from 24% in 2020.

According to a global study by Schroders in 2020, environmental impact and higher returns are the main attraction to sustainable funds.

- 47% of people around the world are attracted to sustainable investments because of their wider environmental impact.

- 42% of people around the world felt the reason they were attracted to sustainable funds is because they are likely to offer higher returns. This demonstrates people expect profit and positive impact to go hand-in-hand.

This study by Schroders is a significant snapshot of investor sentiment, surveying over 23,000 people who invest from 32 locations around the globe. The locations included Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, the Netherlands, Spain, the UK and the US.

Source: Schroders (2020) Global Investor Study: The rise of the sustainable investor

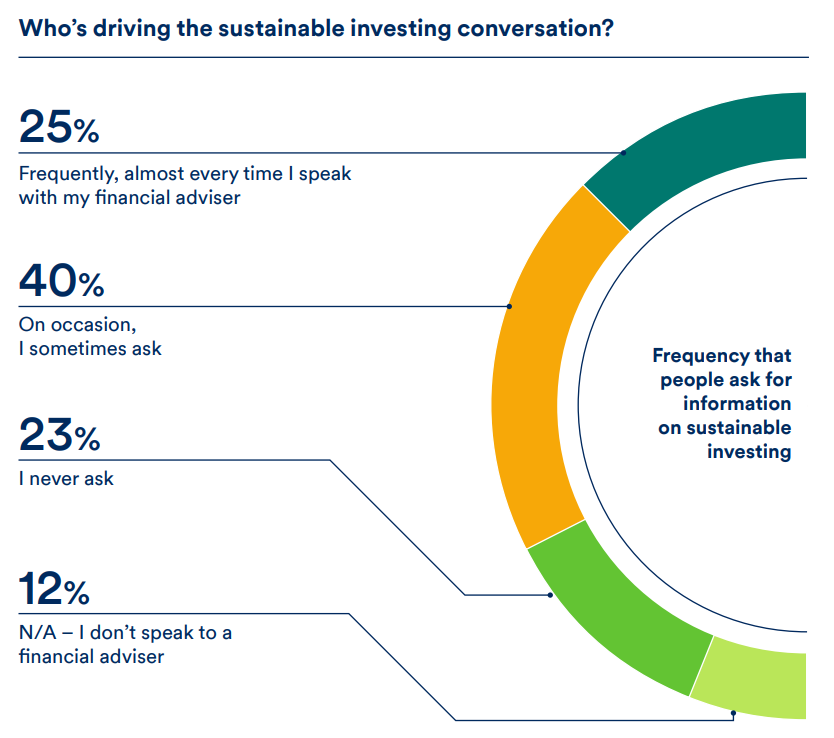

Client-driven conversations are becoming increasingly common, and the demand for advisers to be prepared is on the rise.

“65% of people are driving the topic of sustainable investing forward with their advisers.”

- Schroders

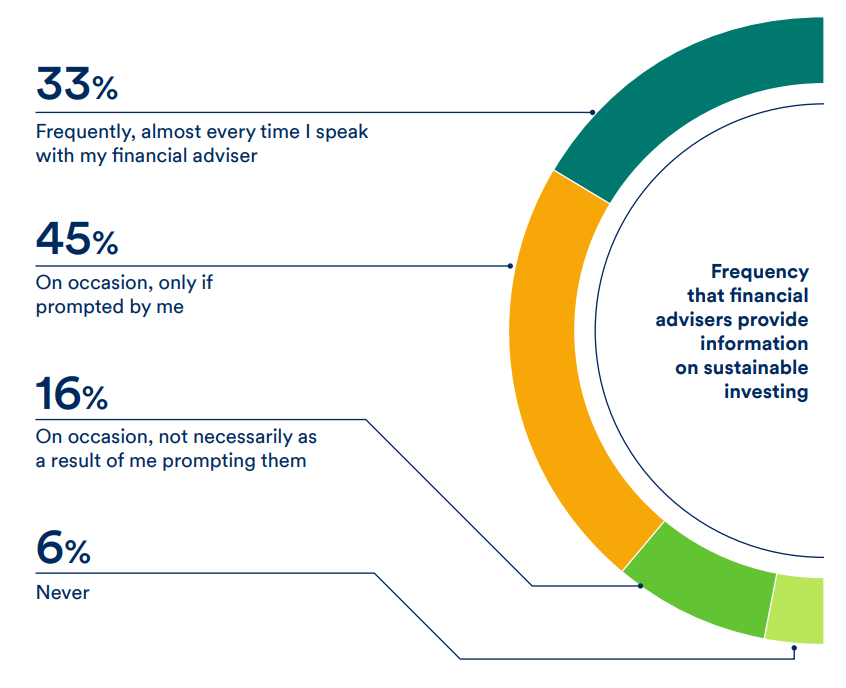

Advisers have not yet caught up with the demand, with only 33% of advisers frequently providing information on sustainable investing with clients.

Source: Schroders (2020) Global Investor Study: The rise of the sustainable investor

- 45% of people claim their financial advisers only provide information when prompted by them regarding sustainable investing.

- 16% of people claim to receive this information unprompted from their advisers regarding sustainable investing.

These results reveal most people are interested in discussing ethical and responsible investing, however, there is much more to be done in increasing awareness and understanding.

From an Australian investor perspective, the 2020 Consumer Study by RIAA (Responsible Investment Association Australasia) shows undoubtedly that clients want advisers to both ask about their ethical preferences, and provide responsible investment options.

Source: RIAA (2020) From values to riches: Charting consumer expectations and demand for responsible investing in Australia

- 86% of Australians believe it’s important their financial adviser asks them about their interests and values in relation to their investments.

- 88% of Australians believe it’s important their financial adviser provides responsible or ethical options.

“Financial advisers have an increasingly important role in helping Australians understand and explore responsible investment options.” - RIAA

It’s not just ethics, morals, and warm fuzzies that are enticing clients to drive ESG and responsible investing conversations with advisers.

There is mounting evidence that clients can invest ethically without sacrificing returns, as indicated in this report by RIAA, showing the financial performance myth is being busted in the eyes of Australian investors.

- 67% of Australians believe ethical or responsible banks perform better in the long-term.

- 62% of Australians believe ethical or responsible super funds perform better in the long-term. In 2017, just 29% of Australians held this belief.

According to an article by FS Sustainability, nearly two-thirds of advisers say that client demand is driving ESG investing. As a result, advisers are focused on upskilling in areas of ethical and responsible investments, including performance, fees, screening methodologies, and the underlying combination of investments.

The next step for advisers, according to Investment Trends and highlighted in an article by the ifa (Independent Financial Adviser), is prioritising education.

The Ethical Advice Accelerator is the ideal program for financial advisers in Australia to get the skills and confidence to provide ethical investment advice, and proactively lead conversations with clients about sustainable investing.

If you would like to learn more about the Accelerator program, you can discover the 5 steps to ethical advice, and download the curriculum, here.

Disclaimer:

This information is issued by Ethical Invest Group (EIG) (ABN 29 238 432 149) in relation to the trend toward sustainability in financial advice.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any investments to rise or fall. This information is not an offer, solicitation or recommendation to buy or sell any financial instrument or to adopt any investment strategy. Although EIG believes that all this information is accurate and reliable, no warranty or accuracy or reliability as to such information is given and no responsibility for loss arising in any way from or in connection with errors or omissions in any information provided (including responsibility to any person by reason of negligence) is accepted by EIG or by any of its agents or employees or by any person providing notes or materials. Any data has been sourced by us and is provided without any warranties of any kind. It should be independently verified before further publication or use. Third-party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither we, nor the data provider, will have any liability in connection with the third-party data. Material may include links to other resources and websites. These links are provided for your convenience only and do not signify that EIG endorses, approves or makes any representation or claim regarding the accuracy, copyright, compliance, legality, or any other aspects of the resources or websites. The material is not intended to provide, and should not be relied on for financial, accounting, legal or tax advice, or the rendering of consulting, or other professional services. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. No responsibility can be accepted for error of fact or opinion. Any references to securities, sectors, regions and/ or countries are for illustrative purposes only. EIG has expressed its own views and opinions in this document and these may change. The contents of the information provided is for your general information and use only. It is subject to change at any time and without notice.

JOIN OUR NETWORK

We’ll ensure you’re informed with regular tips and updates that we love to share with our professional network of leading financial advisers and industry professionals.

Keep up to date with the latest and most compelling trends, research and actions you can take to enhance your adviser-client relationship, and stay in the loop about ESG and ethical investing.