Australian investors have spoken and it is ethical investments they want

Mar 21, 2022

For the first time ever, return on investments is NOT the number one factor that Australians are considering when choosing where to invest their money.

Are you meeting your client’s expectations and satisfying their top priority?

Recent findings from the Responsible Investment Association Australasia (RIAA) have been released and include incredibly telling data, for where the priorities of Australians lie.

The report collated data from over 1000 participants across a broad and balanced age and gender spectrum. It revealed a steady trend towards ethical investments as the standard, not the added extra. As quoted in the Financial Standard, RIAA Chief Executive, Simon O’Connor said of the report, "It should be well known to the finance sector that there is a real risk if you're not considering the values of clients in the way you invest their retirement savings,” as was clearly indicated in the results.

A few key takeaways from the report include:

- 83% of Australians expect their money to be invested ethically by their banks and superannuation funds. However, a massive 72% of Australians are concerned that responsible investors are engaging in greenwashing.

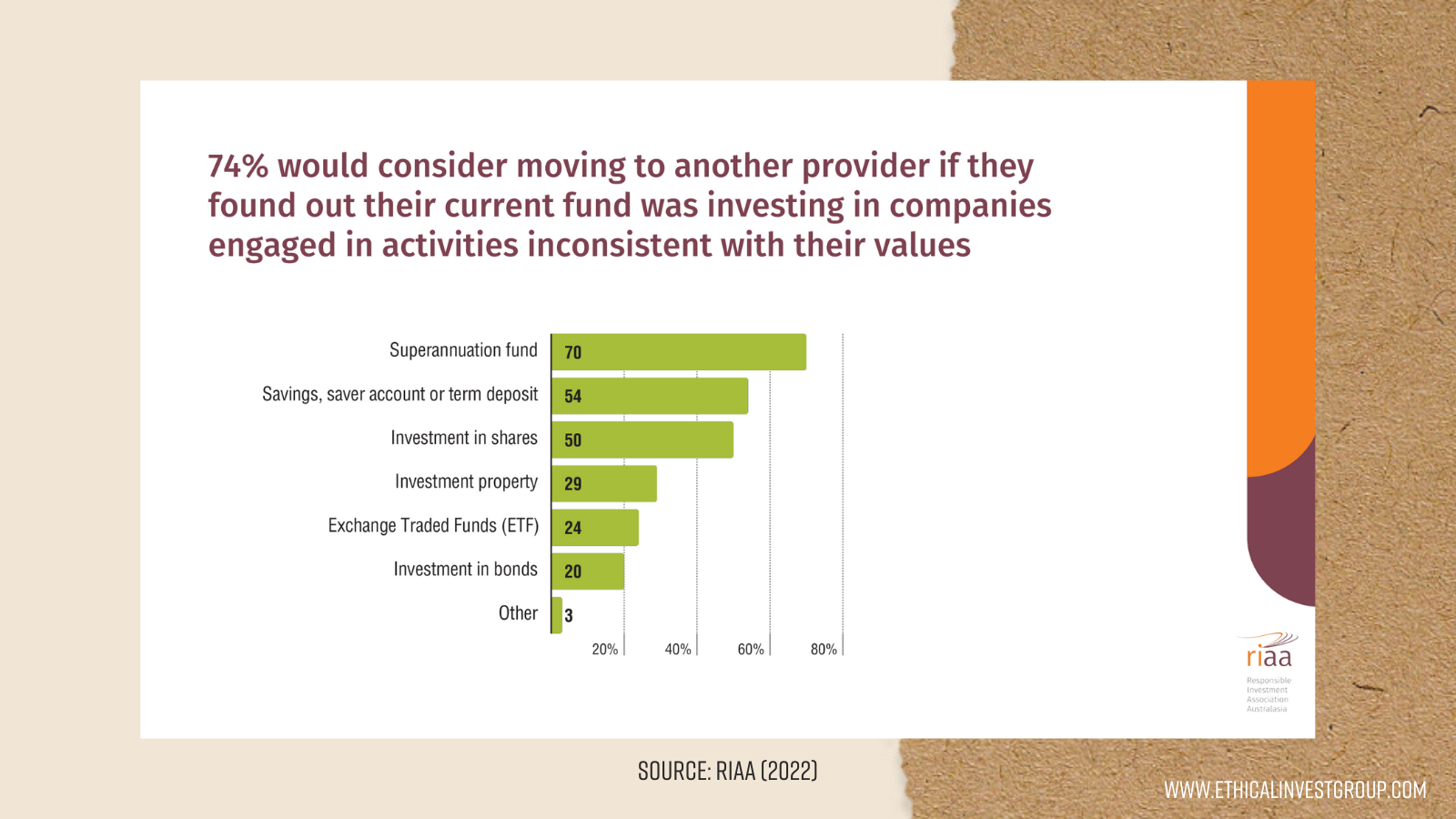

- 74% of Australians would consider moving their provider if they discovered that the investment of their funds was not in line with their values and ethical goals, while 3 out of 5 Australians would aim to save or invest more money if they knew their contributions were making a positive impact in the world.

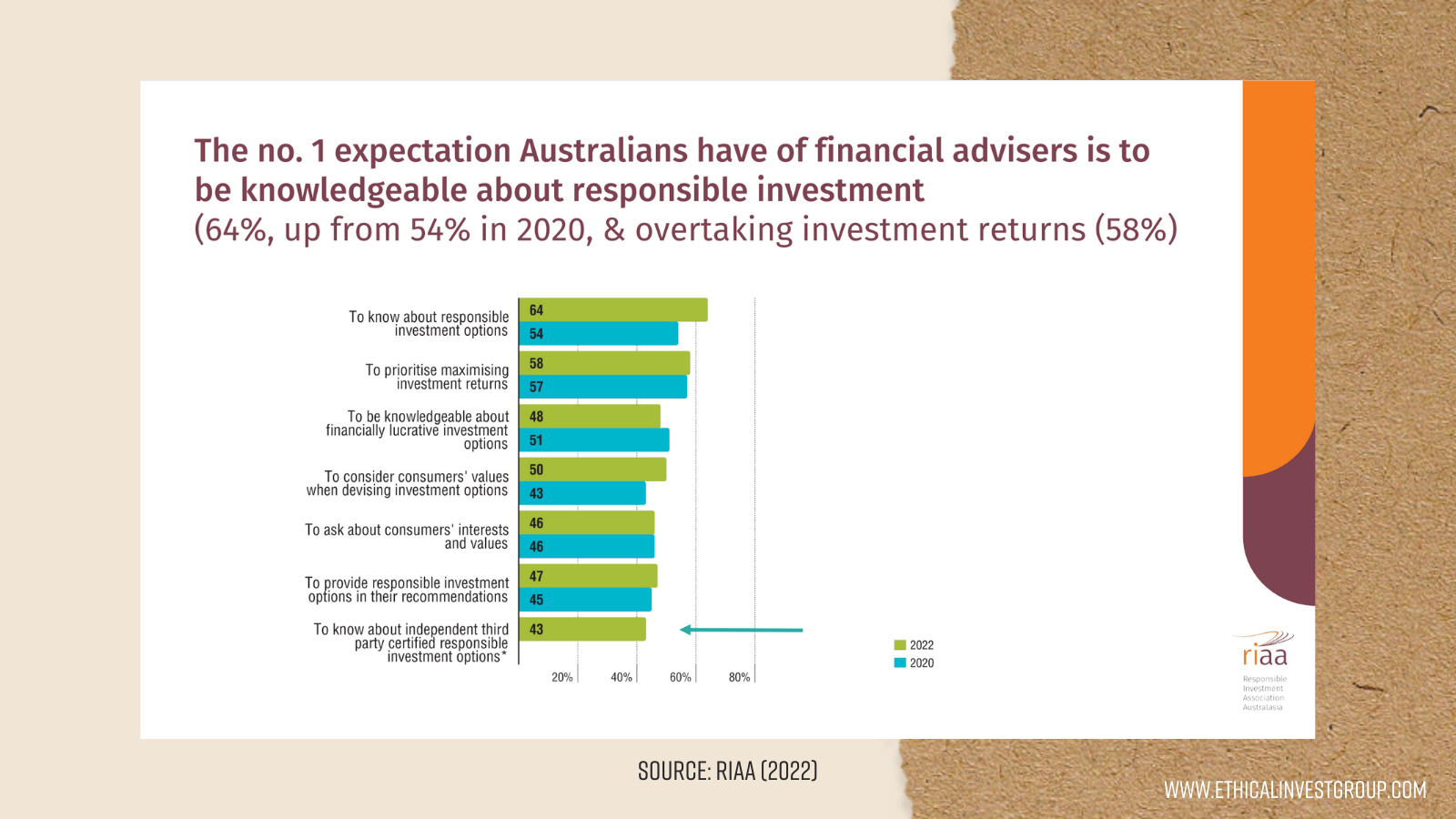

- The number one expectation Australian investors have of their financial advisers is that they are knowledgeable about responsible investments. This has overtaken the expectation that investors prioritise returns on their investments.

So, what does this mean for the immediate future of responsible investing in Australia?

Firstly and most importantly, financial advisers must be knowledgeable in the areas of responsible investing and confident to engage and educate investors about their options.

The overwhelming expectation of Australians is that their money will be invested in ethical and responsible investments. The only way they will feel confident this is occurring is with informed financial advisers talking them through it.

Advisers can use this recent data to look deep into their own investment knowledge and familiarise themselves with a broad scope of environmental, social and governance (ESG) issues, and sustainable investments, and how these areas are aligned to their client’s own values and ethics.

Secondly, advisers must be aware of greenwashing and be skilled at looking deeper into the practices of the companies and investment products they are recommending.

Greenwashing is the practice of using misleading information to disguise negative business behaviours or appear more ethical and responsible than they actually are. Effectively, some product providers are capitalising on the fact that consumers are looking to support those providers and companies who are actually creating positive and sustainable impacts.

“There are a number of funds that are not doing anything different, they are just rebranding because they know they can attract more money by calling themselves ESG funds,” Pablo Berrutti, senior investment specialist at Stewart Investors says. It’s important to understand the name or branding is not always a true reflection of the investment strategy.

“Australians are demanding more transparency from their providers, with 75% wanting to know which companies their super fund, bank or other investments are invested in. They are attuned to the threat of greenwashing, and it's holding many people back, particularly when it comes to switching to an ‘ethical’ bank,” says Simon O’Connor, RIAA CEO.

It’s growing more and more crucial that advisers have the ability to look deeper into the practices of investment products and the underlying holdings in a fund's portfolio, to find the options that accurately match their client’s values. Investors will not stand for greenwashing from their investment providers or the companies they’re invested in.

Finally, Australians are ready and willing to invest and financial advisers are potentially missing out by not aligning their investment options with the values of their clients.

Australian investors want to invest their money ethically! The report shows that Australian investors’ awareness and understanding of ethical investing has doubled over the past two years.

Clients are now:

- Looking to change investment providers, banks and superannuation funds when their current options are not meeting their ethical requirements.

- Seeking advisers and providers who can look at a wider range of issues, and are becoming increasingly aware of social issues, alongside environmental issues.

- Wanting more transparent information from their superannuation funds about the positive impacts their investments are having, and they are greatly dissatisfied with the availability of this information to date.

A recent article in the Financial Review states, “Sustainable investments are attracting capital at six times the growth rate of traditional investments, with assets globally now totaling $US4 trillion across all ESG categories, according to an analysis by global fund manager BlackRock”.

The landscape is set for ethical investments to take centre stage across all investment avenues and the time is now for upskilling and increasing your knowledge, so you can best support Australian investors in these new revelations.

The Ethical Advice Accelerator is the ideal program for financial advisers in Australia to get the skills and confidence to provide ethical investment advice, and proactively lead conversations with clients about sustainable investing. This program shows advisers how to avoid greenwashing, what to look for in an ethical investment product and the right questions to ask fund managers to uncover whether the product will truly align with your client’s values.

If you would like to learn more about the Accelerator program, you can discover the 5 steps to ethical advice, and download the curriculum, here.

Disclaimer:

This information is issued by Ethical Invest Group (EIG) (ABN 29 238 432 149) in relation to the trend toward sustainability in financial advice.

The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any investments to rise or fall. This information is not an offer, solicitation or recommendation to buy or sell any financial instrument or to adopt any investment strategy. Although EIG believes that all this information is accurate and reliable, no warranty or accuracy or reliability as to such information is given and no responsibility for loss arising in any way from or in connection with errors or omissions in any information provided (including responsibility to any person by reason of negligence) is accepted by EIG or by any of its agents or employees or by any person providing notes or materials. Any data has been sourced by us and is provided without any warranties of any kind. It should be independently verified before further publication or use. Third-party data is owned or licenced by the data provider and may not be reproduced, extracted or used for any other purpose without the data provider’s consent. Neither we, nor the data provider, will have any liability in connection with the third-party data. Material may include links to other resources and websites. These links are provided for your convenience only and do not signify that EIG endorses, approves or makes any representation or claim regarding the accuracy, copyright, compliance, legality, or any other aspects of the resources or websites. The material is not intended to provide, and should not be relied on for financial, accounting, legal or tax advice, or the rendering of consulting, or other professional services. Reliance should not be placed on any views or information in the material when taking individual investment and/or strategic decisions. No responsibility can be accepted for error of fact or opinion. Any references to securities, sectors, regions and/ or countries are for illustrative purposes only. EIG has expressed its own views and opinions in this document and these may change. The contents of the information provided is for your general information and use only. It is subject to change at any time and without notice.

JOIN OUR NETWORK

We’ll ensure you’re informed with regular tips and updates that we love to share with our professional network of leading financial advisers and industry professionals.

Keep up to date with the latest and most compelling trends, research and actions you can take to enhance your adviser-client relationship, and stay in the loop about ESG and ethical investing.